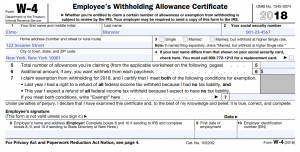

Last week we talked about how a tax refund is actually not a good thing. But how do you prevent a tax refund. Well, when you started at your current employer you were told to fill out an IRS Form W-4, commonly called just W-4.

Last week we talked about how a tax refund is actually not a good thing. But how do you prevent a tax refund. Well, when you started at your current employer you were told to fill out an IRS Form W-4, commonly called just W-4.

The W-4 tells the government about your family situation to determine how much to hold from your paycheck. One would think this form would be easy to fill out but most people are tripped up and do it wrong.

Let’s jump in and figure out how to properly fill it out…

The Personal Allowance Worksheet

When you first see the form the first thing you will notice is the Personal Allowance Worksheet. This is used to determine how many allowances you can claim. The more allowances you have the less the government holds from each paycheck.

This part is pretty easy to fill out. Go ahead and read the directions for each line closely and answer based on your current situation. Now you will put the total number of allowances on line H.

Deductions and Income Adjustments

At this point you are probably assuming you are done and are remembering how easy this form was to fill out. But wait…there’s more! What most people don’t realize is there is a second page to this form. In fact, some employers don’t even hand out the second page. I know I have personally been in that situation where I had to actually request page 2.

Under the Deductions and Adjustments section of page 2 you will need to again follow the directions for each line. This section is for individuals who plan to itemize their deductions, have additional standard deductions, or who have adjustments their income. To assist you with this section the IRS offers a Withholding Calculator that you can easily jump on and go through the prompts.

Two-Earners/Multiple Jobs

Most people don’t even realize that the W-4 allows for changes based on you having multiple incomes personally or within your household. But sure enough, your tax withholdings depend on this critical information.

So, if you are married or have multiple jobs flip over to page 2 and fill out the Two-Earners/Multiple Jobs Worksheet. Line 1 is going to be the number from line H on page 1 or line 10 from the Deduction and Adjustments Worksheet. From there you will use the two tables at the bottom to complete lines 2 through 9. Follow each line exactly as it says.

The W-4

These worksheets were not the actual W-4, but instead help you determine how to fill out the W-4. Now it is time to direct our attention to the actual form.

Lines 1 through 4 are for your personal information. This includes your name, social security number, address, and marital status.

Line 5 is for the number on line H of the Personal Allowances Worksheet or line 10 from Deductions and Adjustments Worksheet. If you used the Two-Earners/Multiple Jobs Worksheet then the total from this worksheet goes on line 6 of the W-4.

Line 7 is to determine if you are exempt and do not have any tax liability. You will fall into this category if you are not required to file a tax return or you do not owe any taxes. You might also be eligible if your earned income is incredibly low. If you fall into one of these categories write “exempt” on line 7.

Now go ahead and sign the form and you are complete.

What if mine is wrong?

If yours is wrong and you didn’t account for a second job, a spouse’s income, or even missed a child, don’t worry. You are legally allowed to update the W-4 anytime you want.

All you have to do is go to your HR professional at work and ask for a new W-4 to fill out.

When you fill it out properly you will either receive a significantly lower tax refund or have to pay taxes. But these are both a good thing. Again, the tax refund is your money all along.

Watch out though, because if you have to pay taxes next year you don’t want to be caught off guard and not have the money.

Joel